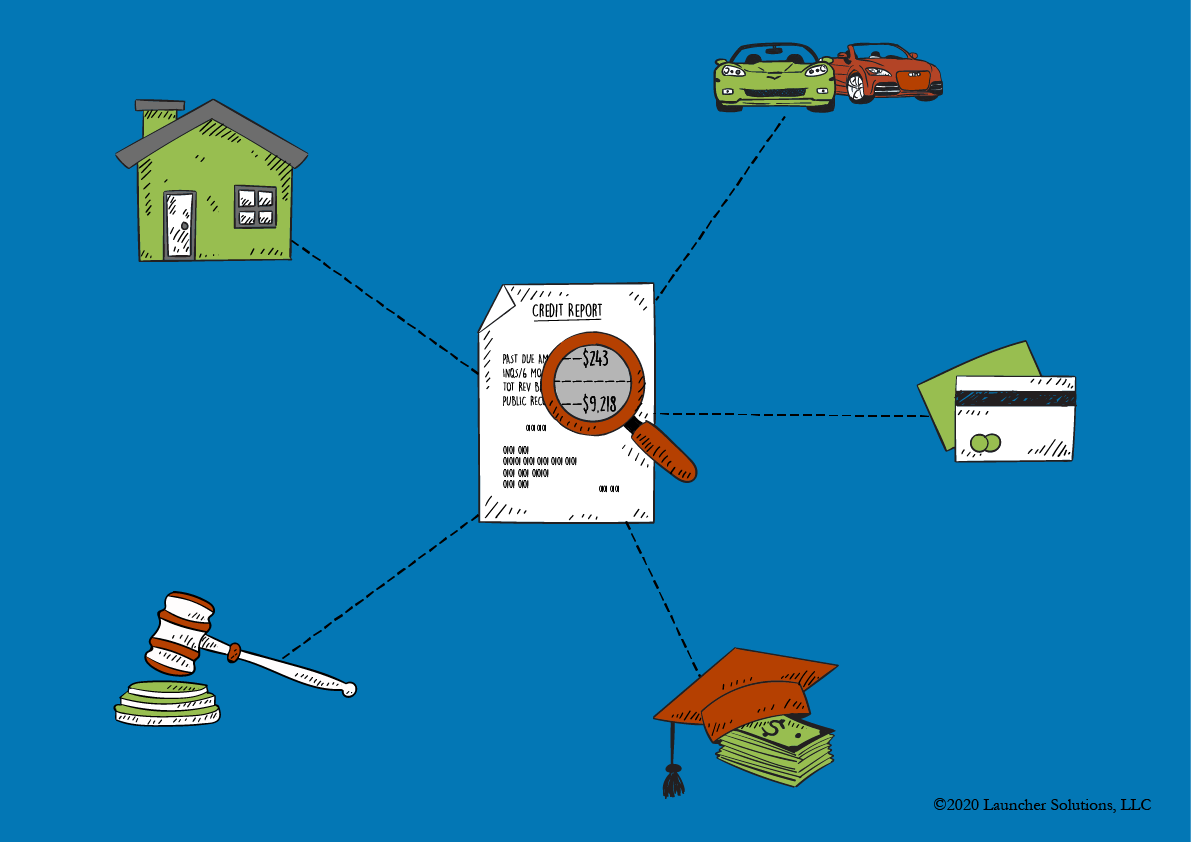

It is pretty standard for loan origination systems to have the ability to pull credit bureaus. Whether by integrating directly with the big three bureau providers or with a bureau re-seller, loan origination systems are built for accessing and utilizing the credit bureau.

It is pretty standard for loan origination systems to have the ability to pull credit bureaus. Whether by integrating directly with the big three bureau providers or with a bureau re-seller, loan origination systems are built for accessing and utilizing the credit bureau.

Sometimes though, you find yourself needing a little bit more from your loan origination system. As you grow, your business rules and models become more complex thus requiring more complex features from your software.

Check out this list of important bureau features that you might want to learn more about:

- Ability to merge credit bureaus: Does the system have the ability to merge two or even three bureaus for your consumption?

- Format and version support: Does the system support all bureau formats such as XML, FFF, and STS? What versions of the bureau does it support? 6.0? 7.0? What kind of presentations are available? Some systems offer more than the standard Bureau TTY with clean, normalized, user friendly HTML and text versions.

- Add-on Products: We all love those little extra data points that the bureau offers! Does your new LOS support those fun products (like MLA, Fraud, and bureau scorecards)?

- Machine Readability: If your system has the ability to make the bureaus machine readable (i.e. normalized to XML or JSON formats for uniformity), you can free yourself from vendor specific coding, minimizing the cost and time spent on extracting bureau information.

- Bureau Attributes: For risk and pricing analysis, bureau attributes can be as good as gold. Does your system aggregate and summarize bureau data from all sections of the credit bureau?

- API and Exports: Does your system offer data to you for offline analysis via API or any other data export process?

- Bureau Test Cases: Your loan origination system may offer bureau specific test cases to match various business scenarios to assist in QA testing.

The best loan origination systems can handle more than just pulling a credit bureau. Does yours?

With appTRAKER LOS, most of these features are available to you without any additional cost. There are no lengthy contracts or expensive integrations to worry about.

If you are looking for a BETTER way to bureau, visit us at www.launcher.solutions to learn more about appTRAKER Loan Origination System.