There is no denying the fact that automation can be extremely beneficial to businesses.

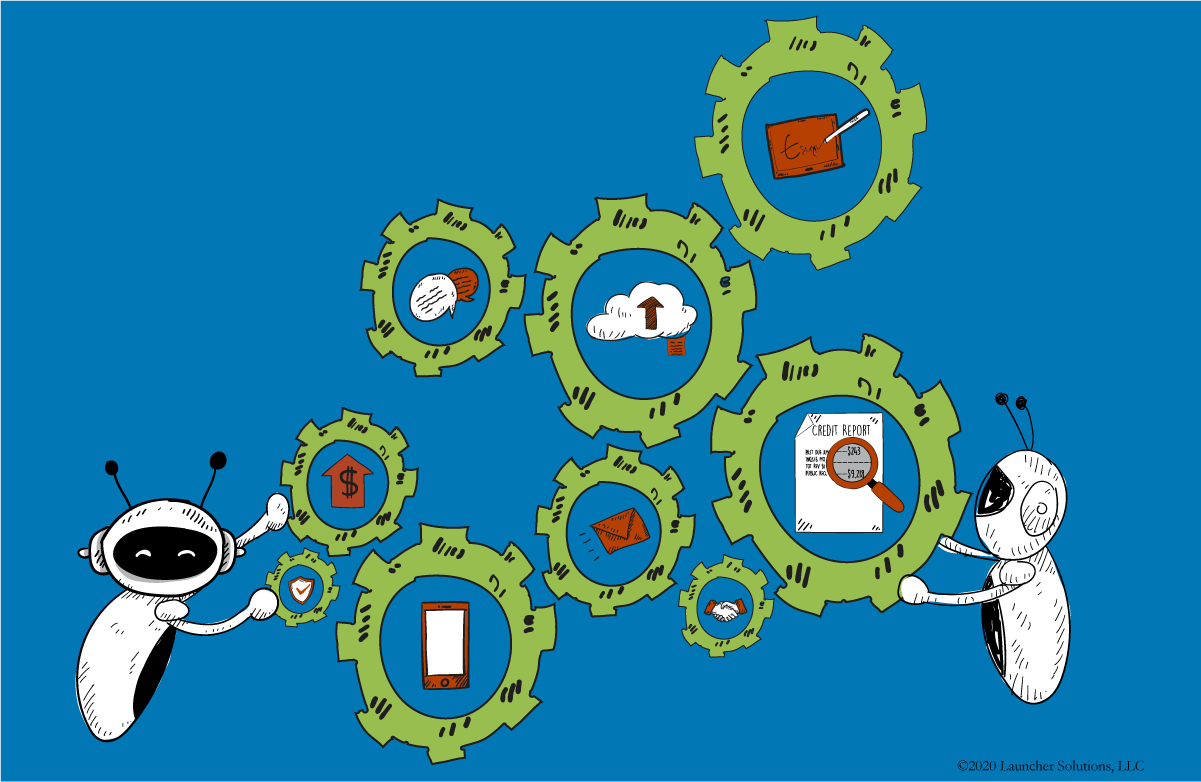

It can help increase efficiencies by reducing human error, reducing operational costs, and speeding up cumbersome workflows and processes.

There is no denying the fact that automation can be extremely beneficial to businesses.

It can help increase efficiencies by reducing human error, reducing operational costs, and speeding up cumbersome workflows and processes.

The point of contention however, lies in the level of acceptable automation…especially for lenders in the subprime space. It isn’t always easy to ascertain at which point the human eye and/or judgment should be involved.

Because of this, it is important to find business software solutions that accommodate varying levels of automation, custom-fit to your business model. For any type of lender, the origination system is a good place to start when evaluating how automation can improve efficiencies.

Lenders should expect automation capabilities in all areas of their loan origination system, including but not limited to the credit application, application processing, risk evaluation, communications and notifications, verifications, and compliance.

Loan Application

Customers, dealers, and retailers should be able to submit a loan application online, whether from a computer or any mobile device, that is designed specifically for the selected loan product. The portals should be customizable by the lender and simple to use for the end-user. Options for automated stipulation and loan document assignment and collection should be included with the ability for customers to e-sign documents before or after loan submission.

Application Processing

The origination system should be able to automatically decision applications based on pre- and post-bureau data. It should also have an advanced rules engine included which takes in application data and runs it against the lender’s scoring criteria and program guidelines. The rules engine can either recommend approvals and declines, or be capable of completely automated decisioning (or some combination of both!).

Risk Evaluation

The advanced rules engine included needs to provides the insights and analytics required to help underwriters make more informed decisions. Automation in risk evaluation can easily help lenders identify and track more variables in order to build a more accurate picture of the borrowers’ financial state.

Communications and Notifications

Automation in the communications realm can not only be a huge time-saver, but can also vastly improve the user experience for customers, dealers, and retailers. Look for customizable email or text message templates that can be sent based on lender-defined triggers. Even internal system notifications should be automated to speed up workflows and keep the process moving.

Verifications

The verification process is imperative to the majority of lenders, whether they serve the subprime market or not. However, the process for subprime lenders can be extremely cumbersome which is why automation in this sphere is so beneficial. Stipulations (loan documents) should be automated, whether they are conditional, coming from the underwriter, or universal stipulations. The system should alert the verification team that new documents have been uploaded into the system automatically to reduce time delays on stipulation collection and their review. There should be automated data collection via third party vendors available, and that automation should extend to verification tasks as well.

Compliance

Finding systems that have automation in program compliance isn’t as common as in other areas. Look for an origination platform that offers customizable authority levels and built-in processes for automatically managing exceptions within the system.

If you are looking for a loan origination system that can help increase efficiencies in your business through automation, check us out!

appTRAKER Loan Origination System includes lender-defined automation in all of the areas mentioned above, and many others (like queue management, document management, dealer/retailer underwrinting, etc.)!