Bookouts are an unavoidable cost for automotive lenders during the origination process.

If lenders hope to protect themselves against extreme losses, it’s a sure bet they are pulling a bookout on a contract’s vehicle that they will potentially purchase. Whether it is during the underwriting process or the verifications process, this is an expense that any risk-adverse lender is stuck with.

Bookouts are an unavoidable cost for automotive lenders during the origination process.

If lenders hope to protect themselves against extreme losses, it’s a sure bet they are pulling a bookout on a contract’s vehicle that they will potentially purchase. Whether it is during the underwriting process or the verifications process, this is an expense that any risk-adverse lender is stuck with.

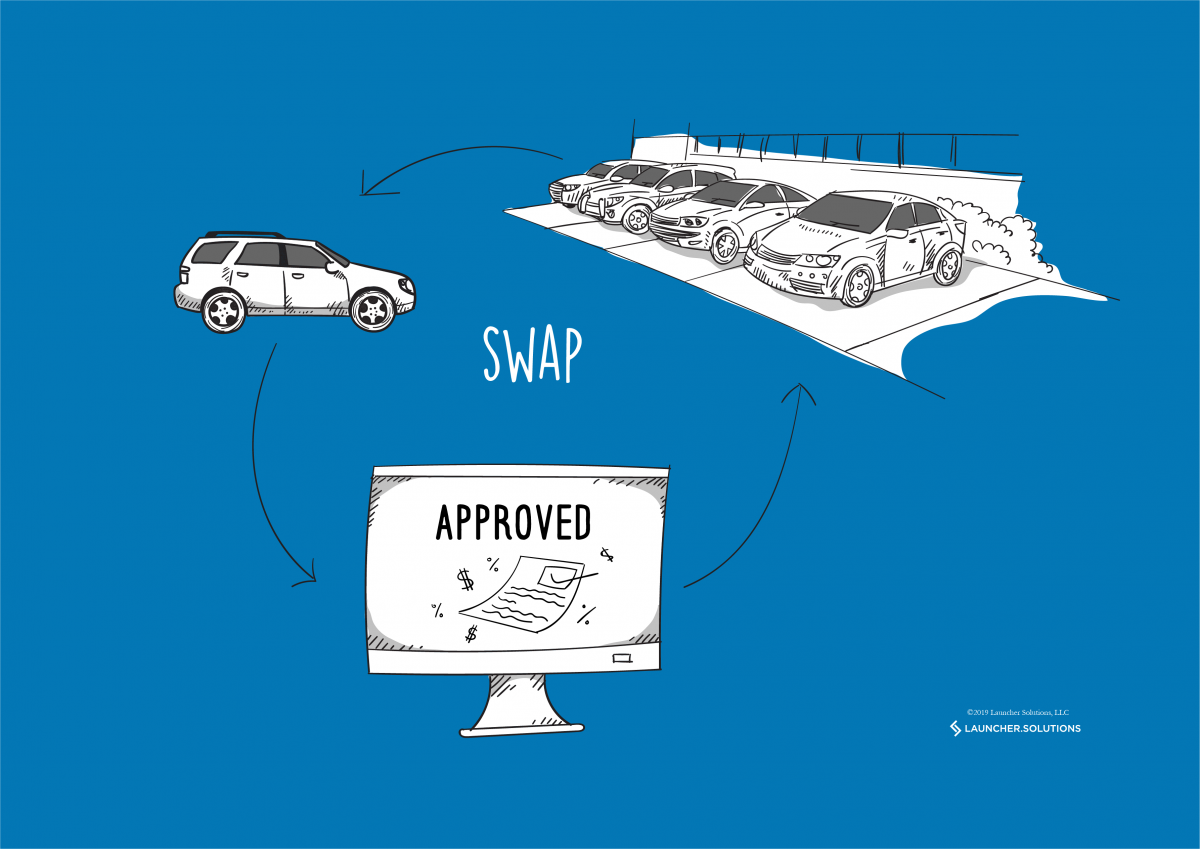

Many origination systems are integrated with the most common valuation vendors (including ours!). Lenders can easily enter the vehicle information (condition, zip code, VIN, mileage, options, etc.) and instantly receive the current value for that vehicle. But what happens when a dealer needs to switch a vehicle multiple times on one credit application?

LOTS OF BOOKOUT CHARGES, that’s what!

When a lender is paying for every single bookout pull, each time a dealer wants to re-car their customer, that can quickly add up for the lender. Switching from car A to car B to car C, and back to car A again can cost the lender significantly (multiply that by thousands of apps per month and it definitely adds up!) To add insult to injury, many times the deal will fall through.

Hasn’t anyone thought of a BETTER way to do this?!

If you’re wondering why you should pay multiple times to pull a bookout on a vehicle that you have already paid for, the answer is “YOU SHOULDN’T”.

appTRAKER Loan Origination System will save a bookout valuation in each dealership’s inventory. That way, when a dealer wants to switch units, there won’t be any multiple charges. appTRAKER also automatically tracks vehicles from multiple applications under the same record.

To learn more about how we try to make a BETTER SOLUTION for our Lenders and their dealers, give us a call 877-5LNCHER