Sometimes fraud happens. Especially in subprime automotive lending.

Most mistakes can be corrected easily when caught in time. But what about those mistakes that aren’t quite so innocent? What can lenders do to help prevent fraud from the very beginning?

Sometimes fraud happens. Especially in subprime automotive lending.

Most mistakes can be corrected easily when caught in time. But what about those mistakes that aren’t quite so innocent? What can lenders do to help prevent fraud from the very beginning?

Fraud can and does occur on many levels.

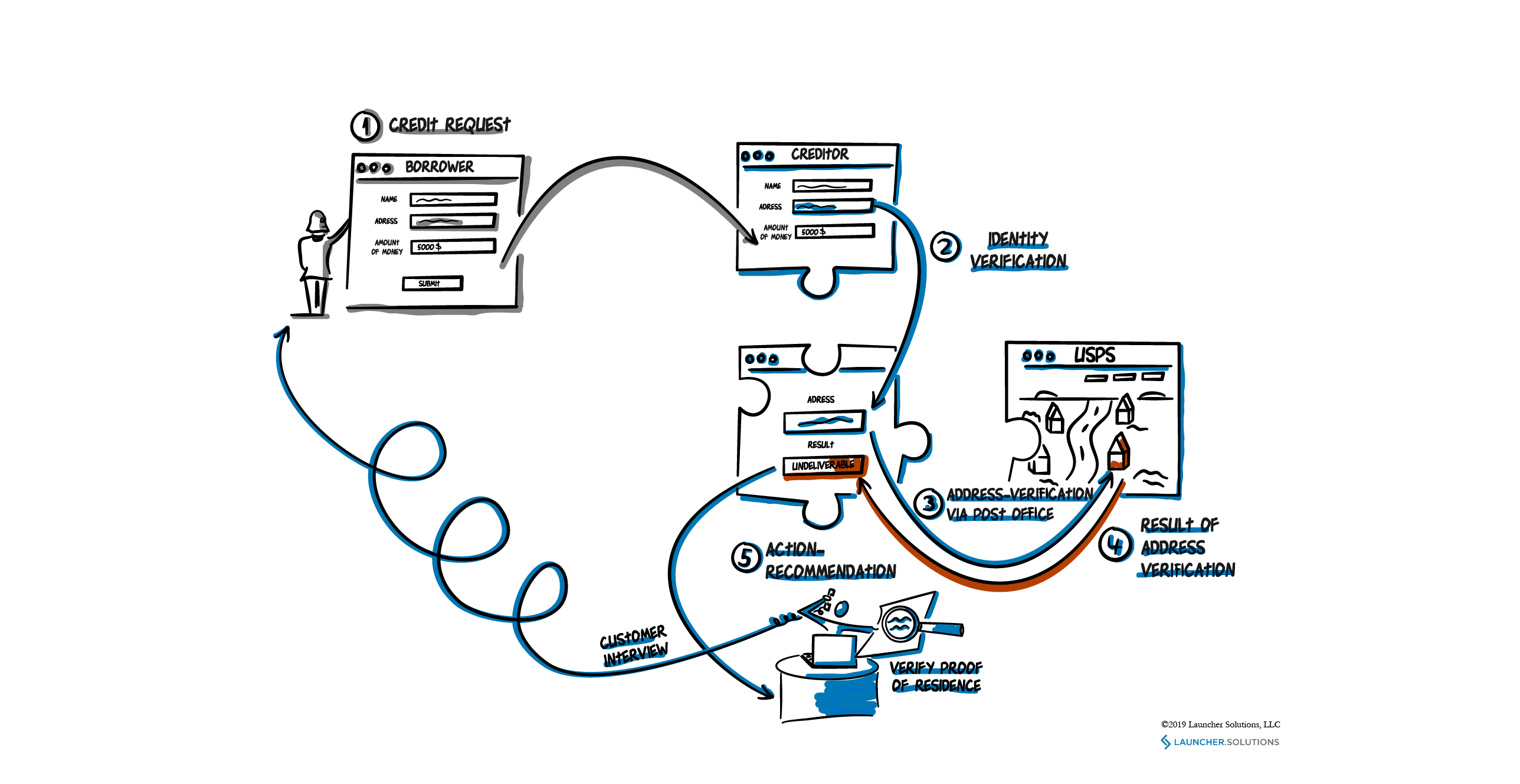

The best way to combat fraud is to attack it on as many levels as possible. Address fraud is a common type found in subprime automotive lending. Credit criminals know that if a lending institution can’t locate a car, they can’t repossess it when the payments go unpaid. For this reason, false addresses are often used.

Wouldn’t it be extremely convenient to be able to verify that an address exists from the get-go?

Yes it would! Built right in to appTRAKER Loan Origination System, address verification can match an input address against the United States Postal Service to make sure it is legitimate. It can also alert the lender if the address is a PO Box or a Commercial address,

Combine this verification with solid Proof of Residency and perhaps even an Address Verification with the Landlord or mortgage company, and a lender is on his way to combating fraud.

To find out how LAUNCHER.SOLUTIONS is battling fraud BETTER, give us a call at 877-5LNCHER or visit us at www.launcher.solutions.